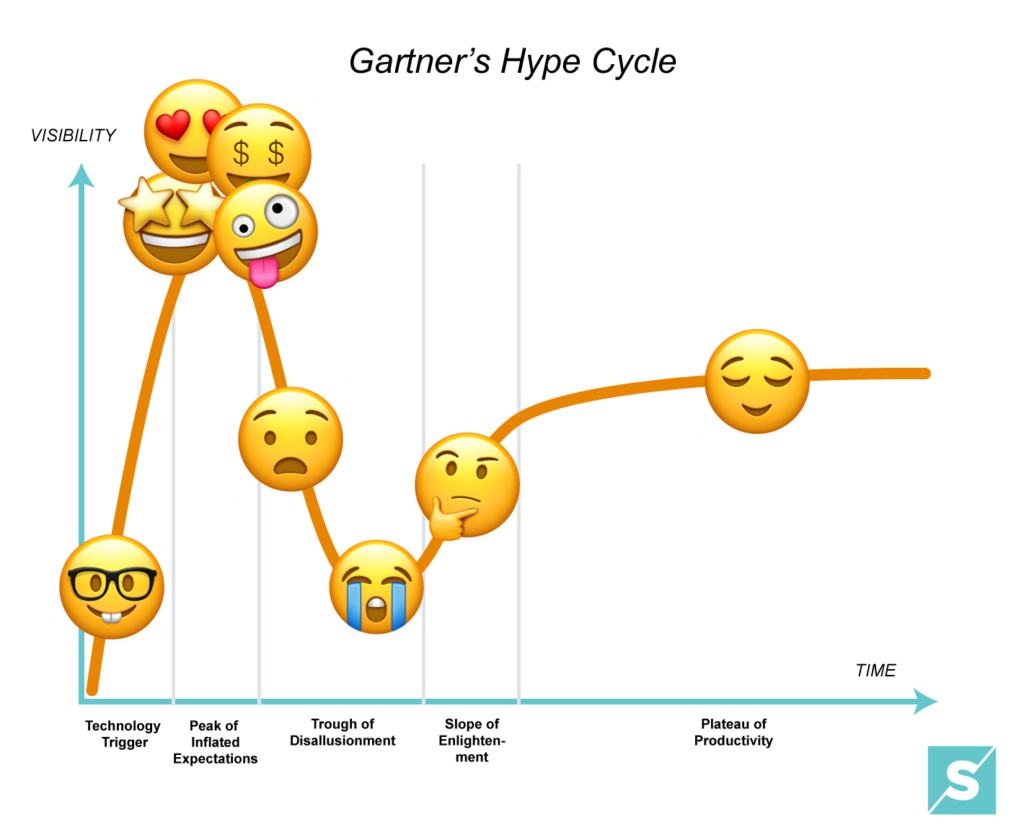

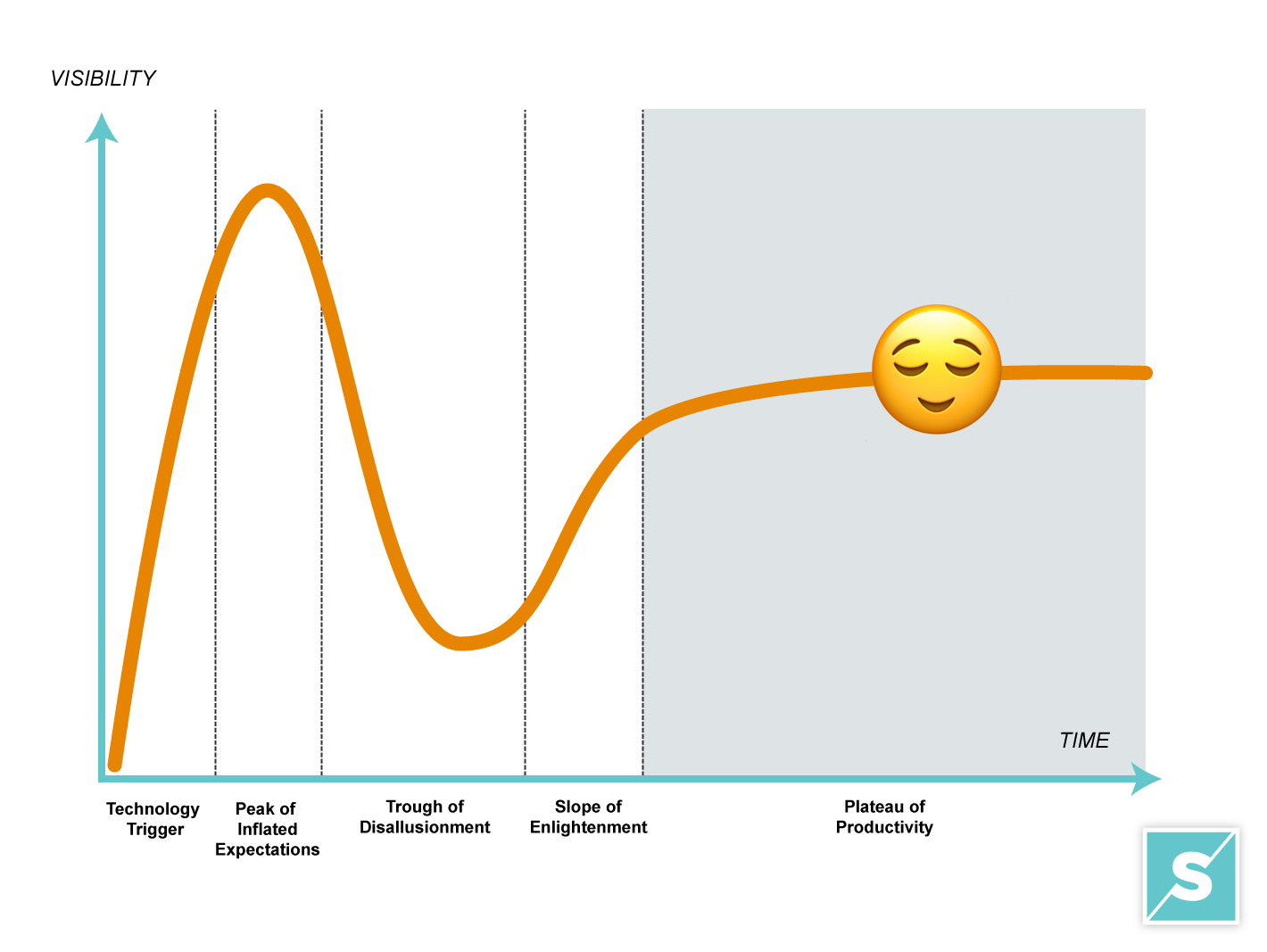

Last week in the blog, I talked about how echo chambers can create wrong-headed predictions about the future. This week, I want to talk about my favorite model for understanding the hype that surrounds a new technology: Gartner’s Hype Cycle. I’ve added emojis to their famous chart because–well–I think that it deserves it!

What it is: Gartner’s Hype Cycle is famous among nerds because it helps you figure out how the hype around technology works. On the vertical axis, we’re charting the amount of visibility that a technology has within our culture. How much is the technology hyped in blogs, social media, conferences, and through business journals? On the horizontal axis, we chart the passing of time. By charting visibility with time, you can see patterns emerge. Those patterns are mind-blowing.

Who made it: The model comes from Gartner, a Connecticut-based consulting firm that offers insight into everything technology-related.

How it works: The best way to explain how Gartner’s Hype Cycle works is through examples. I’m going to talk about the rise, fall, and rise of buying groceries online. Our timeline begins in 1996, and continues 20 years forward to our modern era.

1. Technology Trigger

- Someone invents a new technology and word spread with quickly with other technologists.

- The number of people paying attention to this new technology is very small.

- If the new tech is legit and holds a lot of promise, people come to appreciate the innovation and the hype quickly escalates.

- With the new hype, people find a way to build businesses around the technology, even if they don’t understand it.

Example: Webvan.com was founded in 1996 by Louis Border, the founder of Borders Bookstore. Webvan would offer online ordering of groceries and get free delivery within 30 minutes. Here, our Technology Trigger was a combination of the Internet, the web browser, and online payment processing. eCommerce begins!

- Backed by the belief in the First Mover Advantage, well capitalized eCommerce startups rush in to establish brand recognition with the massive new number of online shoppers. Webvan marketed itself well, all the while building out their website and infrastructure. I was student at Georgia Tech at the time. I saw Webvan ads around the city. It was an exhilarating time!

- In total, venture capitalists invested more than $396 million in Webvan in its first 2-3 years as a company.

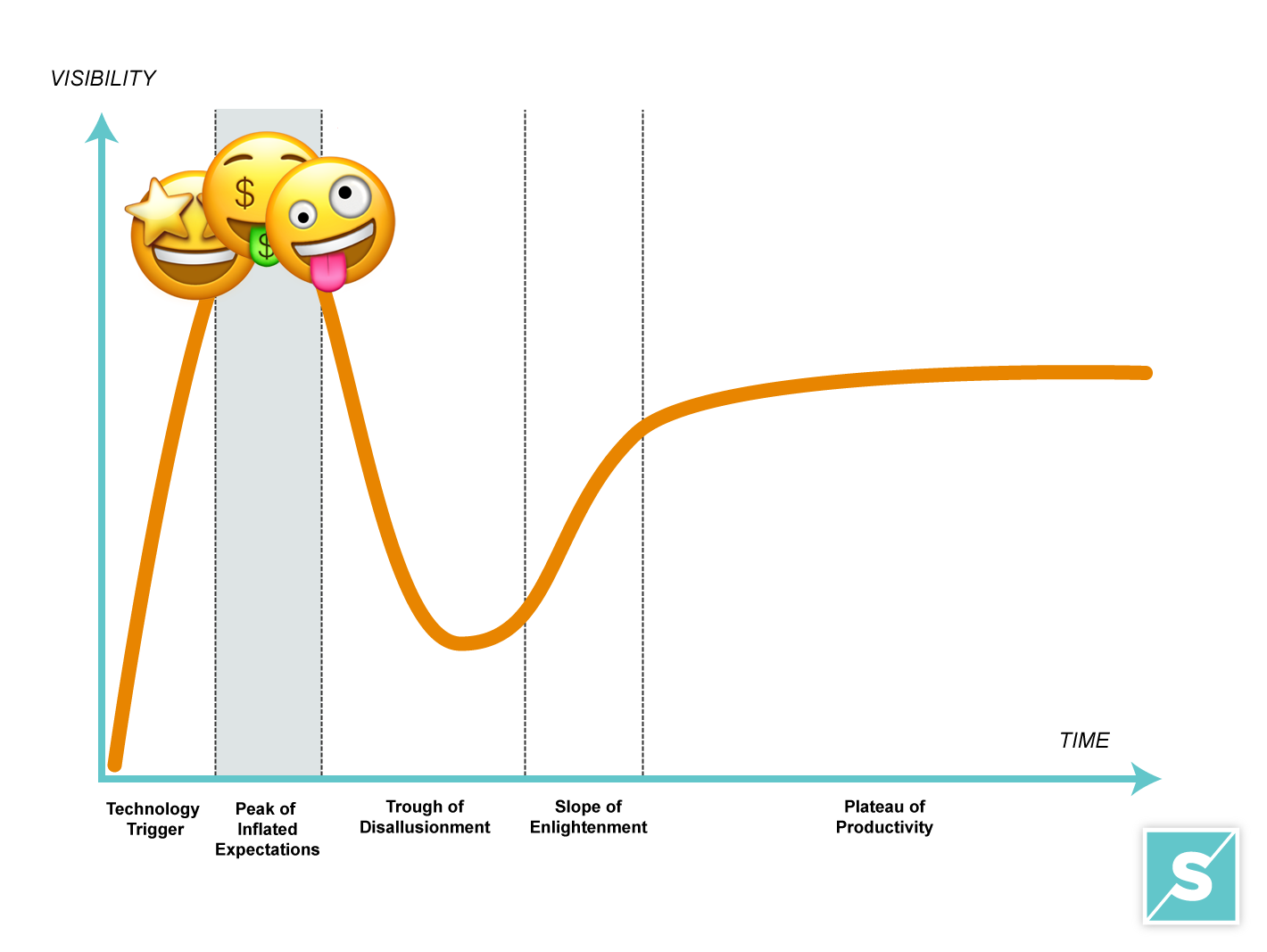

2. Peak of Inflated Expectation

- This is the absolute peak of visibility. Never will there be more buzz about this technology than at this stage in the cycle.

- Thought leaders and pundits take turns adding more hype to the hype. We have an echo chamber!

- People outside the technology adopt it as if it were their own. They do not have full understanding of the limits of the technology.

- Nobody calls them out because they do not want to sound unfashionable or be dismissed as a luddite.

- Dreams become “expectations”

Example: Webvan! Webvan!! Webvan!!!

- “Webvan is an absolute disruptive force that will reshape the industry. They’re not just delivering groceries, but books, and electronics. They’re unstoppable.”

- “The future is now! The game has changed!”

- “Ecommerce will destroy decades old bricks and mortar companies in a mere months. Webvan is leading the pack!”

- 1999: Webvan raised $375 million in an initial public offering in November 1999 that valued the company at more than $4.8 billion. By comparison, Apple was valued at $2.16 billion in late 1999. Side-by-side, Webvan was worth twice as much as Apple.

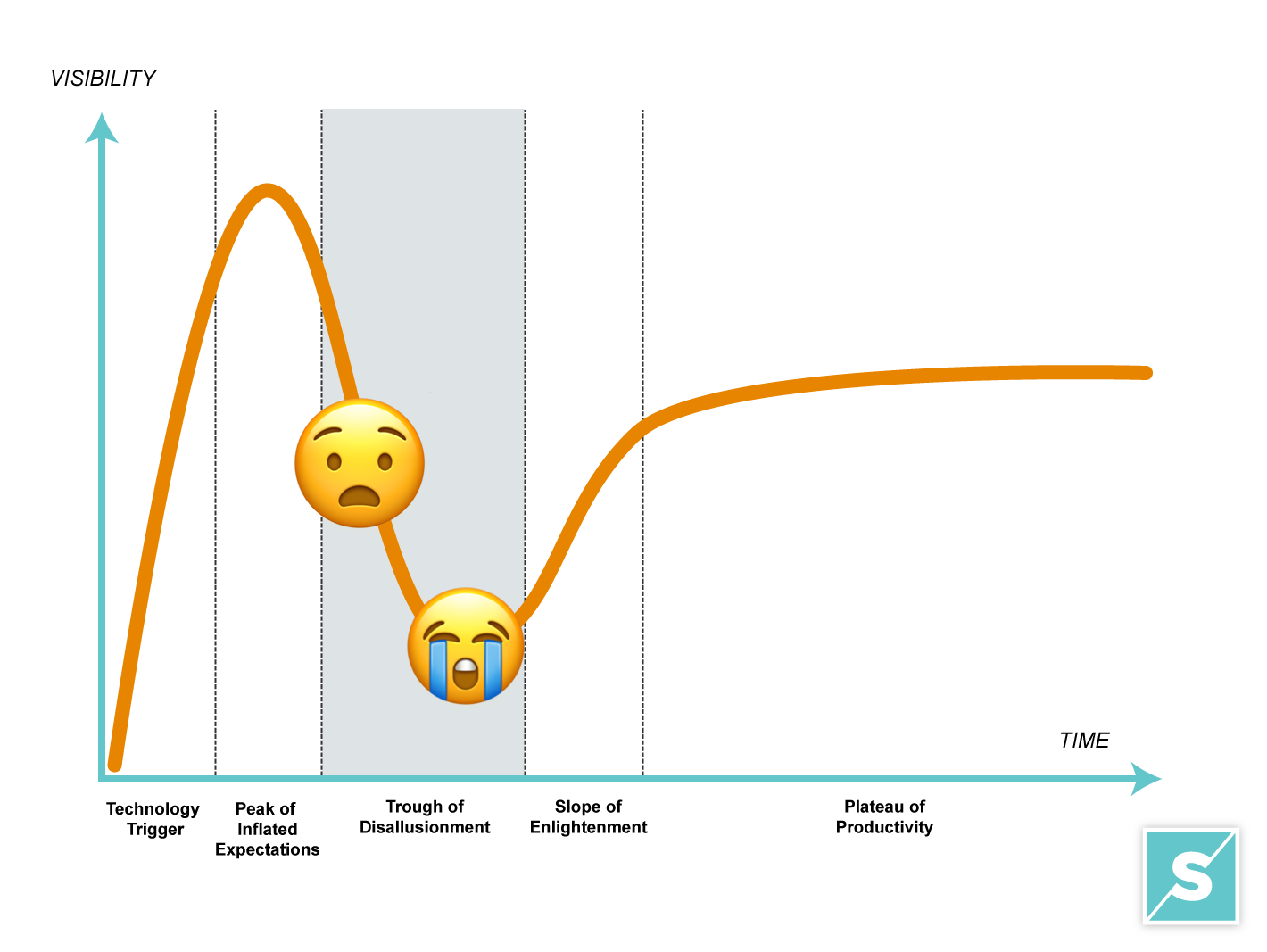

3. Trough of Disillusionment

- Things start to fall apart. Companies built around the technology start to close.

- With time, failed companies outnumber the successful companies.

- There is a collective turn against the tech. Cynicism shows up.

- Everyone feels cool to dis the technology. “I saw this coming!”

- The technology drops out of the mainstream discussion.

Some technologies fall off the hype cycle right here. Either it proves to be a silly idea–a technology fad–or it’s replaced by a new, better technology. However, if the tech has real value, things often begin to trend upward.

Example: Webvan files for Bankruptcy in June, 2001

- The first quarter of the year 2000 stories started to leak out that well-funded, innovative Dotcom companies were closing their doors. This was a shock, and early on, was attributed to poor management.

- Webvan outlasted many, including a competitor HomeGrocer, who Webvan purchased at a reduced price.

- It became clear that Webvan overestimated the number of people who were willing to buy groceries online and have them delivered to their home.

- In the end, Webvan spent more money than it made.

- Webvan wasn’t the only eCommerce venture that failed. There was a long, long list of Dotcom failures, including eToys, Pets.com, and BBQ.com.

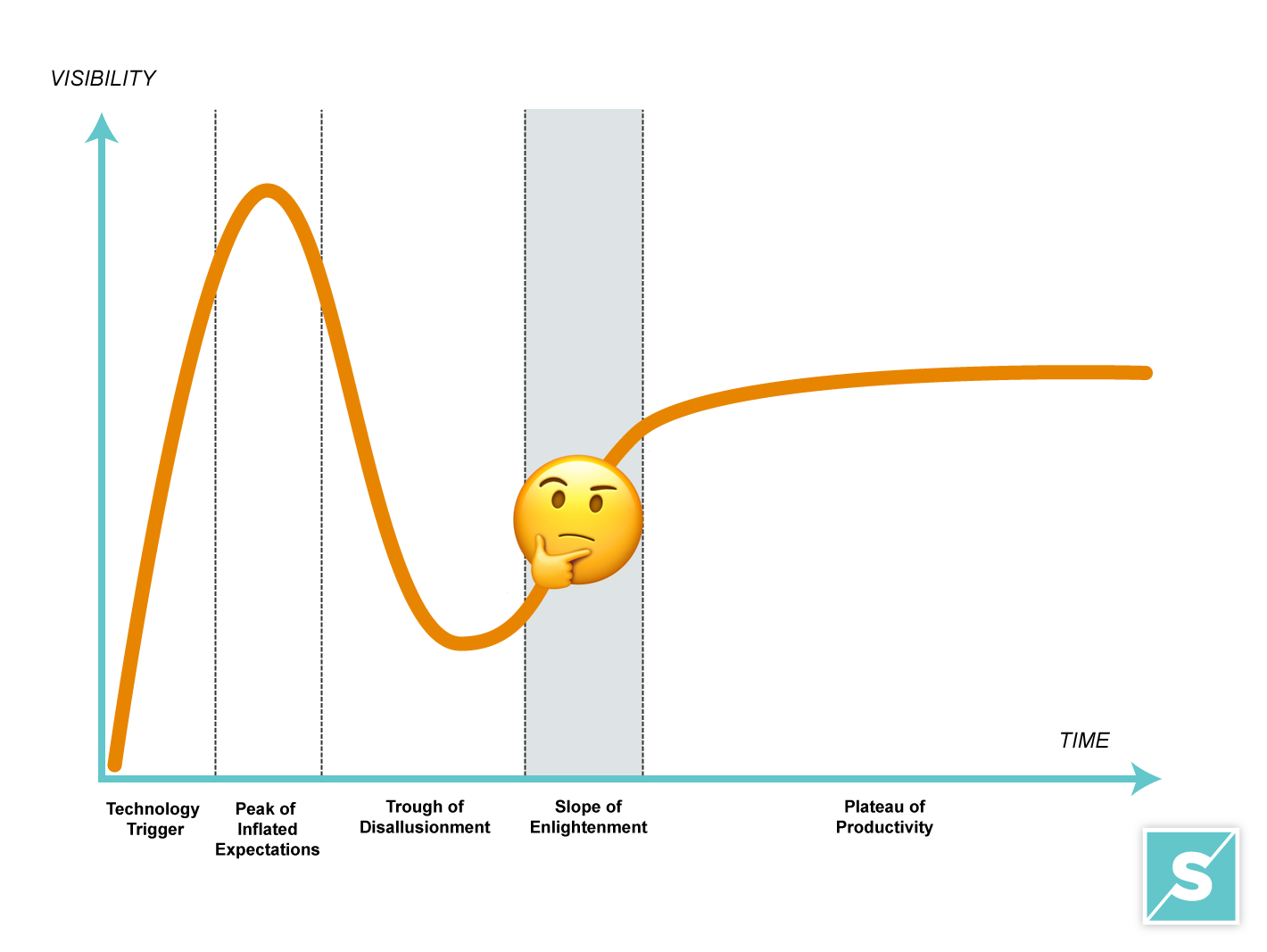

4. Slope of Enlightenment

- Notice that there is very little visibility for the technology. It’s level of exposure in the news and the business chatter is nearly as low as it was before the hype cycle began.

- A few core believers in the technology insist that there is hope.

- Time, persistence, and innovation, the technology opens up opportunities

- Culture changes and people slowly start to warm up to the technology as it’s usefulness is clear.

Example: 2001 – 2006 Webvan executives get hired by Amazon, an online bookstore. The Webvan assets are purchased by Amazon as well.

- Leaders of Webvan bring their experience to Amazon. Some of Webvan’s core infrastructure and technology is adopted and refined internally at Amazon.

- With each year that passes, more people buy things online.

- Online retailers figure out logistics (better shipping!) and easier returns.

- What it sounds like: “Amazon.com posts its 3 year of growth. Although I still think that the stock is overrated, it’s hard to bet against Jeff Bezos.”

With the advent of the iPhone, people enjoy ordering things even when they’re away from their home or work computer. Plus you can easily track packages. It’s kinda fun.

5. Plateau of Productivity

As time passes, the technology succeeds and becomes “life as usual,” but without any of the fanfare as years before. It happens slowly. There is no explosive, magic moment when everyone adopted the technology.

Example: 2006 – 2018 Ordering Groceries Online

With the introduction of Amazon Prime, ordinary people can buy ordinary items (toothpaste, socks, cooking supplies) at great prices and have them quickly delivered to their homes. This created a cultural shift. This has become life as usual in America.

Today, people prefer to buy almost everything online, including groceries. From my own experience, most people today will order their groceries online, but still choose to go and pick them up. But this soon could change. Here’s a recent history:

- 2012: Instacart founded by Apoorva Mehta, a former Amazon employee. Instacart offers home delivery for established grocery stores.

- 2013: Reuters about the launch of Amazon Fresh: From the ashes of Webvan, Amazon builds a grocery business, reception of Amazon Fresh is mixed.

- 2017: Bloomberg: Amazon to Acquire Whole Foods for $13.7 Billion

- 2018: Article on Business Insider: Amazon’s Whole Foods delivery service is off to a roaring start — and it’s a huge threat to Instacart

What is interesting about the example of buying groceries online is that it’s not a linear story of one winner and many losers. Amazon is doing well, as is Walmart. Traditional grocery stores are holding strong with easy online ordering too. This story has been unfolding for 22 years, and it’s still not over.

Summary: Using Gartner’s Hype Cycle

The applications of Gartner’s Hype Cycle are endless, particularly when you are assessing the overall value of technologies. The Hype Cycle is not as useful for predicting who will win sports games, or who will win and have a long and successful career as an entertainer. But where ever there is a clear problem and technology offers a promising solution, you should refine your thinking with the Hype Cycle.

A few points in closing:

- Gartner actually tracks technologies on their Hype Cycle all the time. So you can see how each tech is tracking on the cycle. Recently, Virtual Reality made its way out of the Trough of Disillusionment, and is rising on the Slope of Enlightenment. You can see their cycle from mid-2017 here. (Notice how they have the “Smart Home” peaking, which aligns itself with my last blog about IoT.)

- It’s fun to look around and place tech trends on the Hype Cycle. On any given day, there are 100s of technologies at each part of the cycle. Today, something has reached it’s Peak of Inflated Expectation at the same time a technology has reached the Trough of Disillusionment.

- The Hype Cycle doesn’t explain how every tech company will perform; this is not a trend line for stock value. However, the Hype Cycle helps you recognize patterns. You can see that very strong companies can be battered because, collectively, everyone is down on their core technology. So if you’ve always dreamt of buying low and selling high, pay attention to tech sectors in the trough and look for the strongest companies who have what it takes to move up the slope.